By Victoria Fry, Financial & Independent Living Skills Coordinator CLE Costa Mesa

Creating routines, making changes, and sticking to resolutions is tough work. But don’t worry, we developed four lists for creating routines, waking up, meal planning and money management. Breaking down big goals into micro tasks can help you reach the goals you’ve been working on.

CREATING ROUTINES

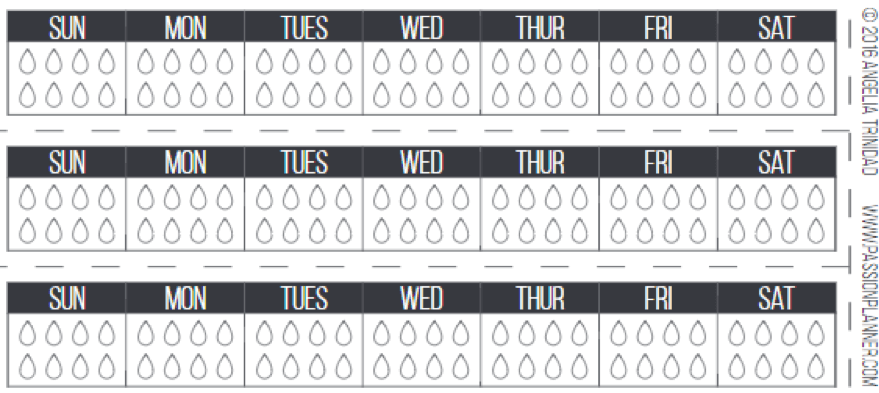

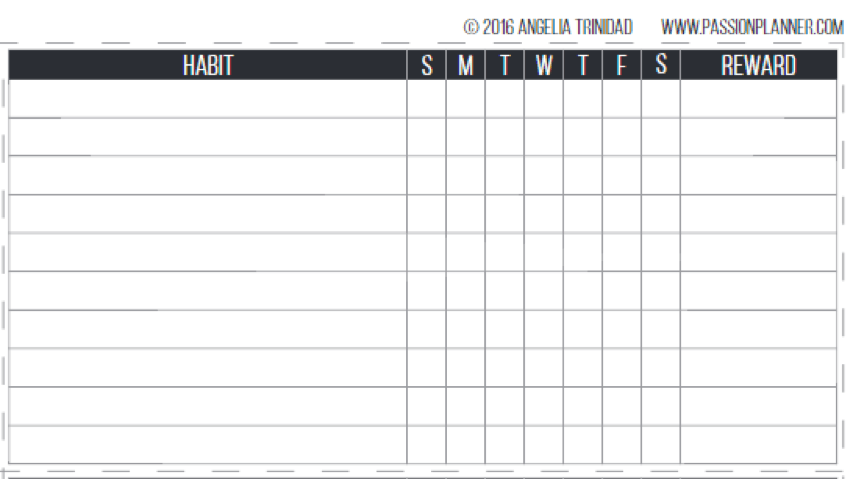

- Draw it out: Not only do visuals help track your progress, they’re also incredibly rewarding. Start by identifying a habit and craft something inspiring to you. Write it, color it, print it, there are incredible sources of inspiration on the world wide web to help you set or track goals like Passion Planner.

- Set small goals: As they say, Rome wasn’t built in a day (and neither are healthy habits).

- Identify how your ‘small goals’ play into the bigger picture. For example, today you’re running a quarter-mile, but after six months, you might be running two miles. Growth is continuous and it’s important to set small, achievable goals so that you can feel your success.

- Track your progress. Not only does tracking add accountability, but it gives you an opportunity to reflect on how freakin’ great you’re doing!

- Celebrate Success: Having a treat to look forward to makes you more likely to stick to your goals, and to be honest, you deserve it.

- Be flexible: Sometimes you will meet your goals, and other times you won’t. Be patient with yourself and focus on the success you achieved.

- Share the news: When you’re meeting your goals, share about it. Whether it’s around the dinner table or over social media, you deserve other people celebrating your success. Who knows, they might be inspired to make changes themselves.

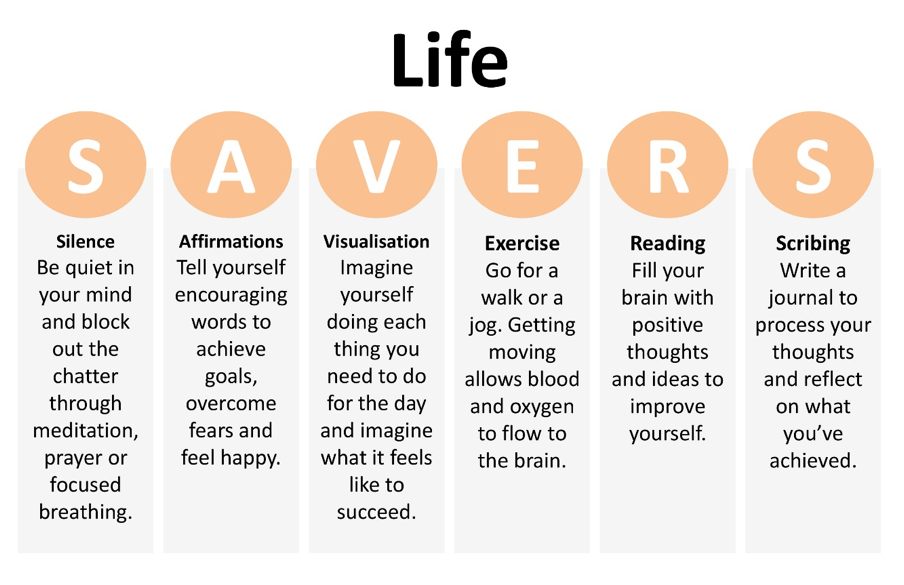

WAKING UP

- Find your motivator: What is one thing that makes you excited in the morning? Coffee? Listening to music before heading out? Having some quality time with your pets? All solid answers.

- Set your alarm of the other side of the room: This way you will need to get out of bed to turn off the sound, and for some people, getting out of bed is the hardest part!

- Open and let the light in: It will help you wake up naturally.

- Prepare tomorrow’s clothes, backpack, and lunch to make mornings easy: The less hassle, the more you have to look forward to.

- Positive self-talk goes a long way: Check out this video for an instant spike in self-confidence.

- Value your sleep: Seriously! A great night sleep can make waking up early a breeze. We all deserve to wake up feeling refreshed and ready to start a new day.

- Snoozing is losing: ‘Nuff said.

- Wake up and smell the routine: Set an alarm for when you need to go to sleep and wake up in the morning and do your best to keep your routine stable. This will help your internal clock naturally set and rise.

- Celebrate your success: Buy a nice pair of slippers or play a game of cards before leaving for work. You have a bit more free time now, so take advantage of it!

MEAL PLANNING

- Write it down: What is your intention? Why is meal planning important to you? Be specific.

- Make your list and stick to it: Identify the meals you want to make, gather your recipes, then make your list. Keep in mind, you can use a staple ingredient like chicken and use it in three different meals. For example, you can make chicken tacos, chicken noodle soup, or chicken fettucine.

- There are resources that do it for you: From books to phone applications or YouTube videos – there is an incredible range of resources available to help you cut the work out of meal planning.

There are resources that do it for you: From books to phone applications or YouTube videos – there is an incredible range of resources available to help you cut the work out of meal planning.

There are resources that do it for you: From books to phone applications or YouTube videos – there is an incredible range of resources available to help you cut the work out of meal planning. - Manage your time: When looking at recipes, multiply the ingredients and make multiple servings of the same meal. Not only do you get a second helping of something you (obviously) enjoyed, but you’re saving time.

- Do it all in one day: Seriously – then, you can just grab n’ go throughout the workweek.

- Pre-made is okay: Cut the work out of meal preparation by purchasing pre-cooked chicken, pre-chopped veggies or microwavable rice. There’s no shame – if it makes the process more enjoyable for you, go for it.

- Don’t forget your snacks: When you prepare some healthy snacks, you will be less likely to purchase more expensive items at convenience stores.

- Sharing is caring: If you’re making lunch for yourself, offer to make a portion for your classmate or friend.

- Show your skills: Make a picture-perfect meal? Post about it on social media! Not only are you inspiring others to cook, but you’re giving other people an opportunity to ask for your recipe.

MONEY MANAGEMENT

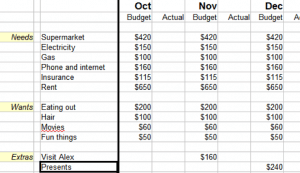

Set a budget: Where does your money go? What is important to you?

Set a budget: Where does your money go? What is important to you? - Create a savings goal: Do you want a new video game? Or a trip home to see your family? These are all fantastic goals to save for. Having a concrete goal in mind will help you identify how much you need to put aside every month.

Visualize your goal: Once you’ve set your goal, make it visual. Print out a photo, set a photo as your phone background, and look at it every single day. Being reminded of your goal on a daily basis will help you remember why you decided to save money.

Visualize your goal: Once you’ve set your goal, make it visual. Print out a photo, set a photo as your phone background, and look at it every single day. Being reminded of your goal on a daily basis will help you remember why you decided to save money. - It all adds up: If you purchase a $5.00 latte every day for 1 month, the total is going to add up quick ($150). Use this handy calculator to identify what habit you should curb.

- Visualize it: Every week, take a moment to update your budget. How much money have you spent? Where is it all going? Write your totals down and identify your spending patterns.

- It’s all about attitude: Every time you decide to pass up that shopping trip, think about it in positive terms. You just made $100 of extra income that you didn’t have to work for – fantastic!

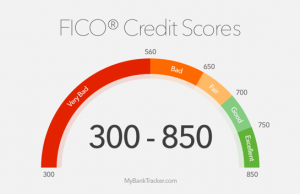

Pay your bills on time: Your credit score will thank you.

Pay your bills on time: Your credit score will thank you. - Plan for the unexpected: When does your bus pass expire? When do you need to pick up your medication? Make sure that you have important dates written down so that you can save money for these purchases.

- Plan to splurge: If you’re shopping and you see a new video game that you want to buy, wait two days before purchasing it. If the game is still in your mind for two days, go back to the store and buy it.

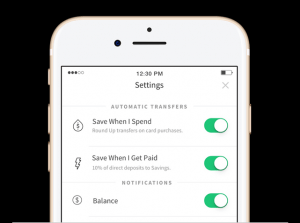

Automate your savings: This can be done by setting up an automatic bank transfer through an account like

Automate your savings: This can be done by setting up an automatic bank transfer through an account like